STREAMLINE YOUR WORKFLOW, CLIENT REPORTING, AND PROVIDE YOUR AGENCY WITH REAL MARKET INTELLIGENCE

The i3 platform consists of web-based dashboards and tools to help your agency automate reporting, maximize customer retention, mitigate the ultimate cost of claims, identify positive and negative outliers in your portfolio and turn your data into actionable analytics.

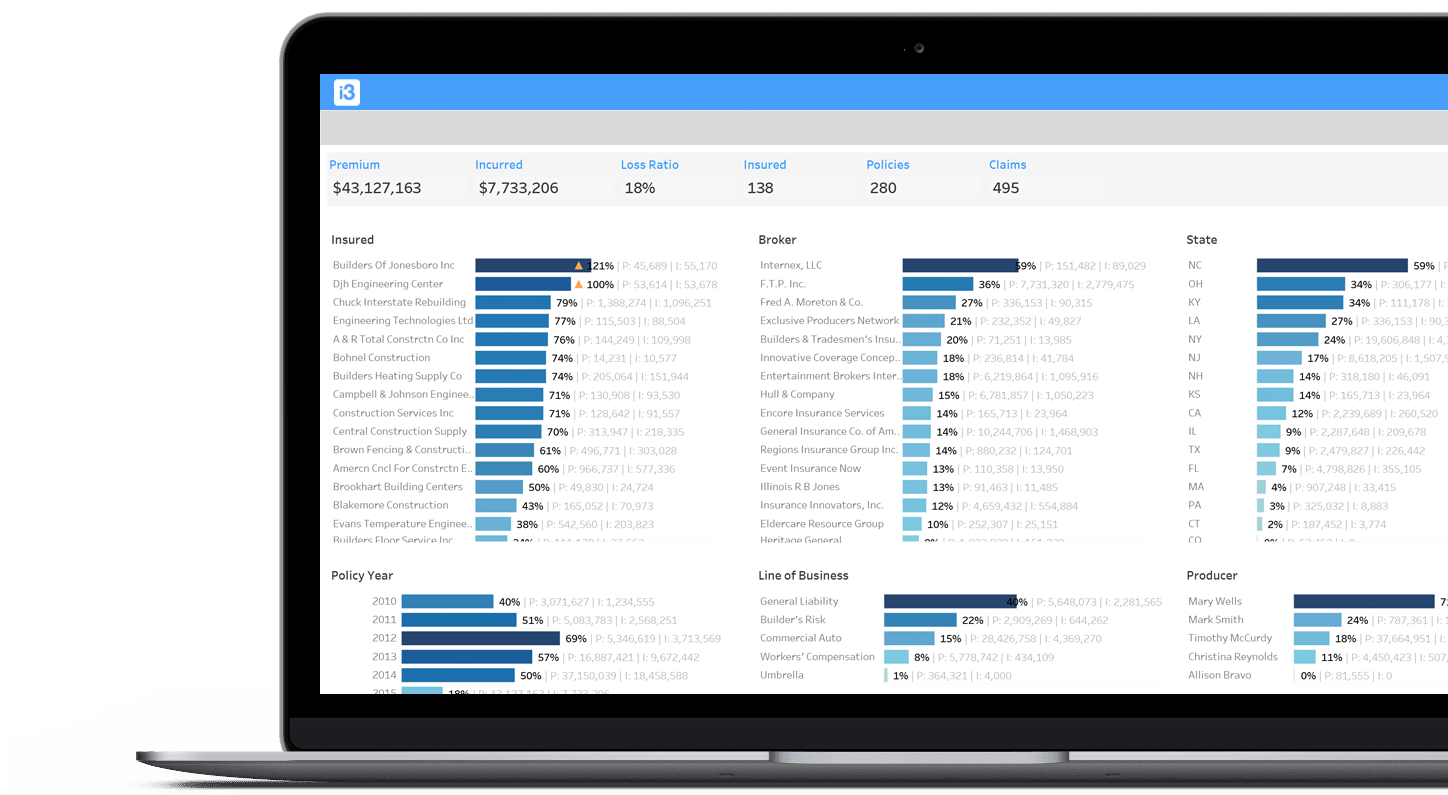

Easily manage your agency

____________________

- Track and manage insurance activity for your agency

- Understand customer relationships across every asset

- Benchmark policy activity trends over time and assets

- Run a full agency analysis to view loss ratios, premium volumes, commission rates and more in seconds

- Quickly simulate your portfolio with or without individual segments with our Include/Exclude functionality

Maximize customer retention

____________________

- Proactively manage upcoming renewals

- Recover lost business by reinserting non-renewed accounts into your sales pipeline

- Identify cross-sell opportunities at point of renewal

- Access customer performance history with the click of a button for more granular detail at renewal

- Monitor non-renewed business

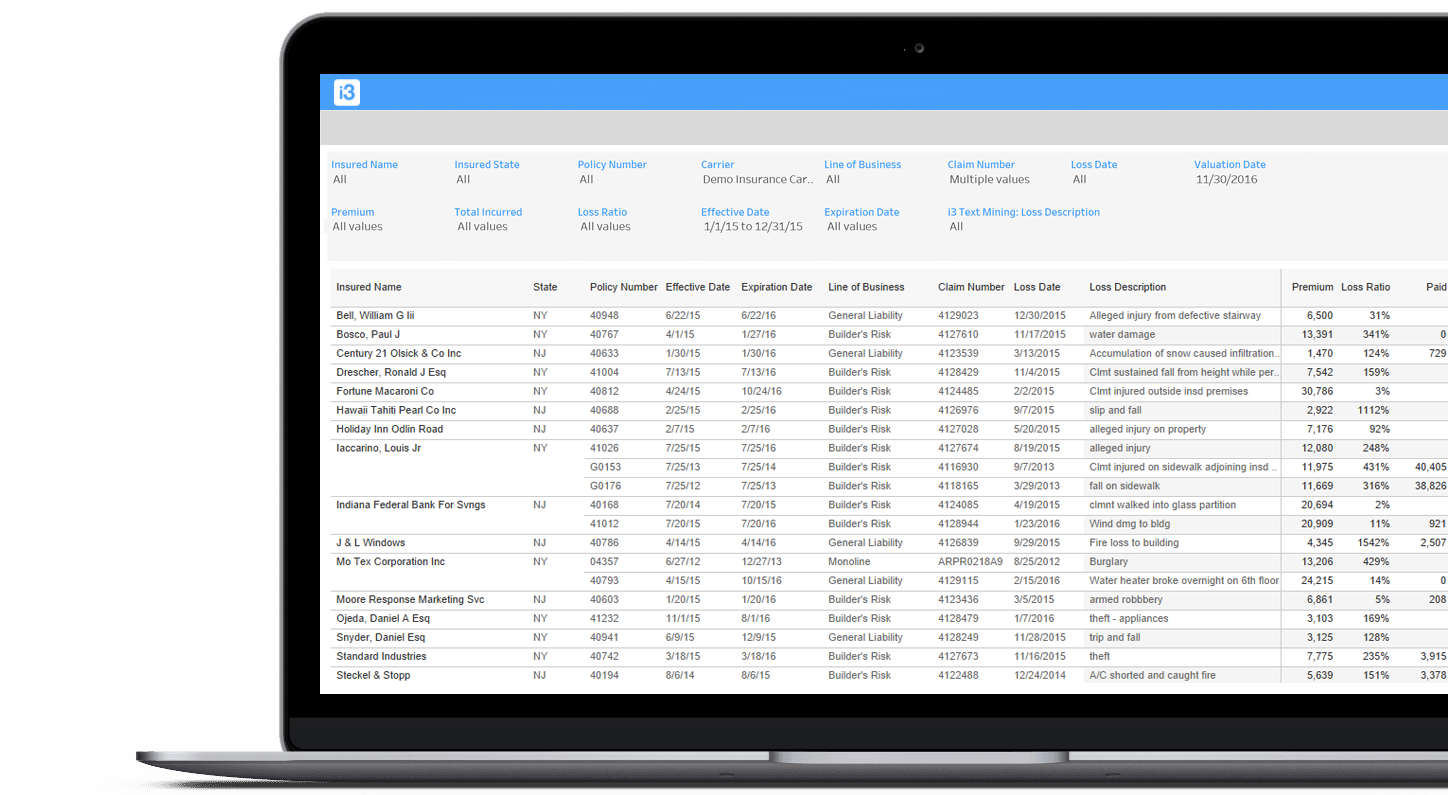

Rapid claims insights

____________________

- Monitor all claims activity across multiple carriers from one location

- Track open claims to measure changes in incurred and reserve values

- Identify claims outliers to mitigate the total cost of risk

- Easily identify severity and frequency drivers within your portfolio or program

- Utilize a private labeled loss run creator to generate branded loss runs for your retail agents and insureds

- Analyze loss develoment with automated incurred and paid loss triangles

Customized reporting

____________________

- Create custom reports in Excel or PDF

- Create agency reports that bring your policy and claims data together in a robust and clean document

- Leverage a variety of filters to segment and customize your reports

- Produce branded reports and documents with our private-labeling capabilities